What is Renters Insurance and Why is It Necessary for Every Renter?

Many individuals are wary about the use of insurance in real estate. This is why we see most people, especially renters, asking: what is renters insurance?

Renters insurance, also known as tenant insurance, is an insurance policy designed to provide coverage to individuals who are renting a house, apartment, or condo. It would be important to understand that the landlord insurance policy only protects the owner’s physical structure, not the specific tenant’s belongings or liability. A typical policy provides coverage for all the listed areas at the previous point, often for only a small price.

Table of Contents

What Is Covered by Renters Insurance?

The next question that arises is: what is liability coverage for renters insurance? A typical renters insurance policy, commonly referred to as HO-4, consists of three main categories of coverages.

- Personal Property Coverage: Protects your private property (household furniture, electronics, clothes, appliances) against damages or theft from certain risks such as fire, theft, vandalism, smoke, or water damage because of plumbing problems.

- Note that it extends to your property even if it is no longer at home. This may include items stolen from your car or even while you are away from vacation.

- Personal Liability Protection: This coverage will protect you if you are legally liable for bodily injury to other people or for damaging other people’s property. The example given for this coverage involves a visitor slipping and falling into your apartment or biting someone with your dog; this coverage pays damages with a minimum of $100,000.

- Additional Living Expenses (Loss of Use): In case the rentable property is rendered unoccupiable through a covered loss (for example, a fire makes an apartment unoccupiable), it pays for additional living expenses, hotels, and restaurant meals.

What is Renters Insurance Cost?

Rental insurance is also deemed to be one of those insurances that have the lowest premiums.

- Average Cost: As of 2025/2026, the average cost of renters insurance in the US ranges from $13 to $23 per month or $160 to $250 per year.

- Factors Affecting Cost: The premium you pay is based on your location, credit history, deductible level, and level of coverage (e.g., $10,000 coverage vs. $50,000 coverage).

- Savings: Purchasing your renter’s coverage and auto insurance from the same firm might result in discounts.

What is Not Covered?

Standard policies have certain excluded risks, and this is where you may need to purchase additional coverage.

- Flood & Earthquake Damage: Damage from floods & earthquakes is rarely covered.

- Valuable Items: Jewelry, artwork, or collectibles may have a sub-limit in a policy (for example, only $1,500 for a jewelry burglary loss), and you may be required to purchase a ‘scheduled personal property endorsement’ for comprehensive coverage.

- Damage to the Building: The responsibility of damage done to the walls, floors, or structure lies with the landlord.

- Property of Roommate: Items of a roommate are not covered, unless specified within the policy.

Why Every Tenant Needs It

- Your landlord is Not Responsible for Your Stuff: If your stuff gets destroyed in a fire, you are responsible for replacing them, not the landlord.

- Liability Protection: A lawsuit resulting from an injury to a visitor or any damage you cause to the building-anything from running a faucet incessantly, for instance-can be financially ruinous.

- It Is Often Required: Most landlords require proof of renters insurance when the lease is signed.

- Affordable Safety Net: You can safeguard thousands of assets for the cost of a few streaming subscriptions.

Tips for Choosing a Policy

- Choose Replacement Cost Value over Actual Cash Value: It only pays for the depreciated value of your used item, while RCV covers the cost to buy a new one.

- Take a Home Inventory: Itemize your possessions and take photos. Note serial numbers to make sure you have sufficient coverage.

- Choose a Manageable Deductible: It accounts for the sum you pay out of pocket prior to the insurance taking over. A higher deductible provides a lower monthly premium.

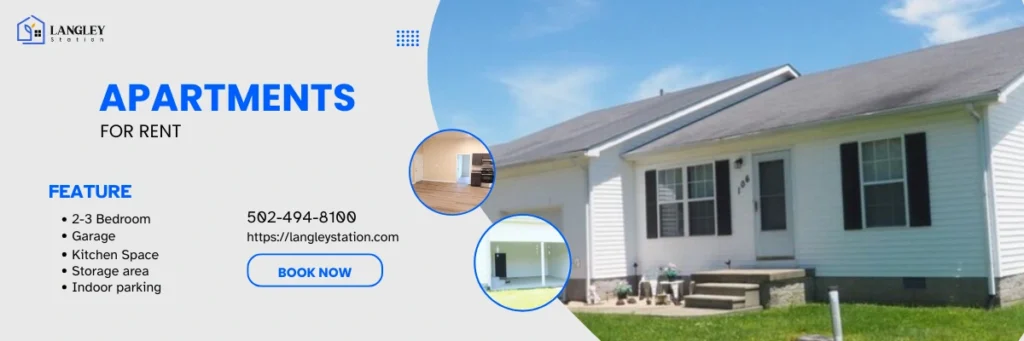

If you are still confused, you should contact Langley Station to get expert advice. They offer a hassle-free rental finding process and will help you protect your investment with tailored insurance guidance.

Conclusion

So, what is renters’ insurance for? It is a smart and cost-effective protection that all renters should consider. From protecting your own private property to protecting you against expensive liability claims and unexpected living expenses, smart renters insurance can save you from serious financial troubles. Having flexible protection options and low-rate premiums, renters insurance provides a peace of mind that outlasts its cost.

If you are a first-time renter or renewing a lease agreement, buying the right renters insurance policy is one of the wisest decisions that will protect your home and secure your future.

Frequently Asked Questions

Renters insurance is not mandatory in most states; however, many landlords require it. Even when it is not mandatory, it is highly advisable because it will protect you financially in circumstances when the insurance of your landlord is inapplicable.

You can purchase personal property coverage in an amount that will replace all your belongings. This can simply be estimated in a home inventory. Most people purchase coverage limits of between $20,000 and $50,000 for their property and liability coverage of at least $100,000, which is ideal, but higher limits can also provide better financial protection.

Yes. Renters insurance typically protects your property even when it is outside of your apartment. If you have your laptop stolen from your car or hotel room, your insurance will pay claims for that loss.

Usually, no. Most policies encompass just the named insured. It is necessary that each roommate in the house has their own insurance unless the insurer approves more than one unrelated tenant as their policy holder.

Renters insurance can be obtained in mere minutes either online or through an insurance agent. In fact, the coverage begins instantly, or in the case of online purchases, in 24 hours, making this the fastest insurance to obtain.